Financial targets

Strong profitability, high environmental performance and safe, healthy workplaces create the conditions for stable, successful operations over the long term.

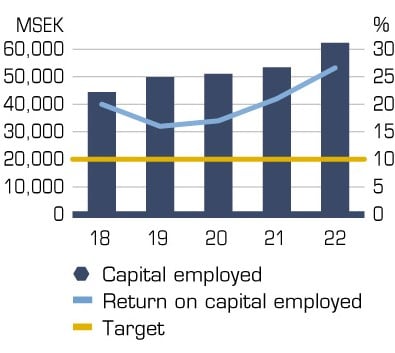

Return on investments

The return on investments shall be at least 10 percent.

The return on investments shall be at least 10 percent. Any projects must be in line with strategy and available resources. The return on operating activities measured as a return on capital employed was 27 percent (21). During the period 2018–2022, the rate of return averaged 20 percent per year.

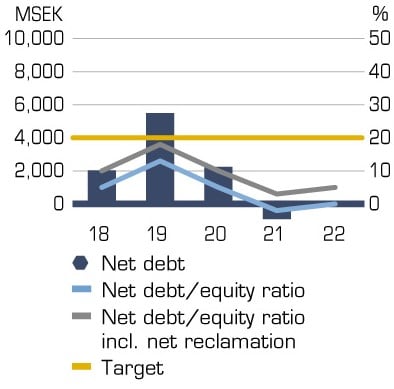

Net debt/equity ratio

Boliden strives to achieve a net debt/equity ratio in an economic upturn of approximately 20 percent.

At the end of 2022, the net debt/equity ratio was 0 percent (–2). Furthermore, the net reclamation liability corresponded to 5 percentage points. The change in comparison to 2021 is due to a lower free cash flow, primarily as a result of higher investments.

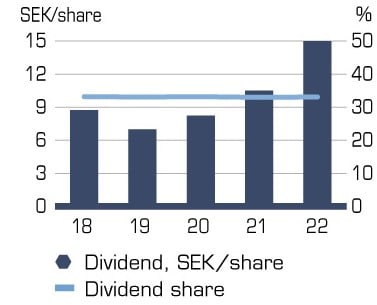

Dividend

The dividend shall correspond to one third of net profit for the year.

The proposed ordinary dividend is SEK 15.00 (10.50) per share, equivalent to 33.1 percent (33.0) of profit for the year. In addition, an extra disbursement in the amount of SEK 11.50 (15.50) per share was proposed through an automatic share redemption procedure. During the period 2018–2022, the ordinary dividend per share was 33.1 percent of the period’s total net profit.